Indian fintechs raised $9 billion in 2021. The funding came with the promise of innovation, with the promise of building models which haven’t been built before to serve customers’ needs that have not been addressed. But while dealing so closely with money and finance, regulations have to be adhered to. Regulations exist to protect the interest of end customers. They exist to ensure that short-term benefits do not hurt long-term financial independence. We recently saw such an innovation, which prospered for a while and was shut down soon after.

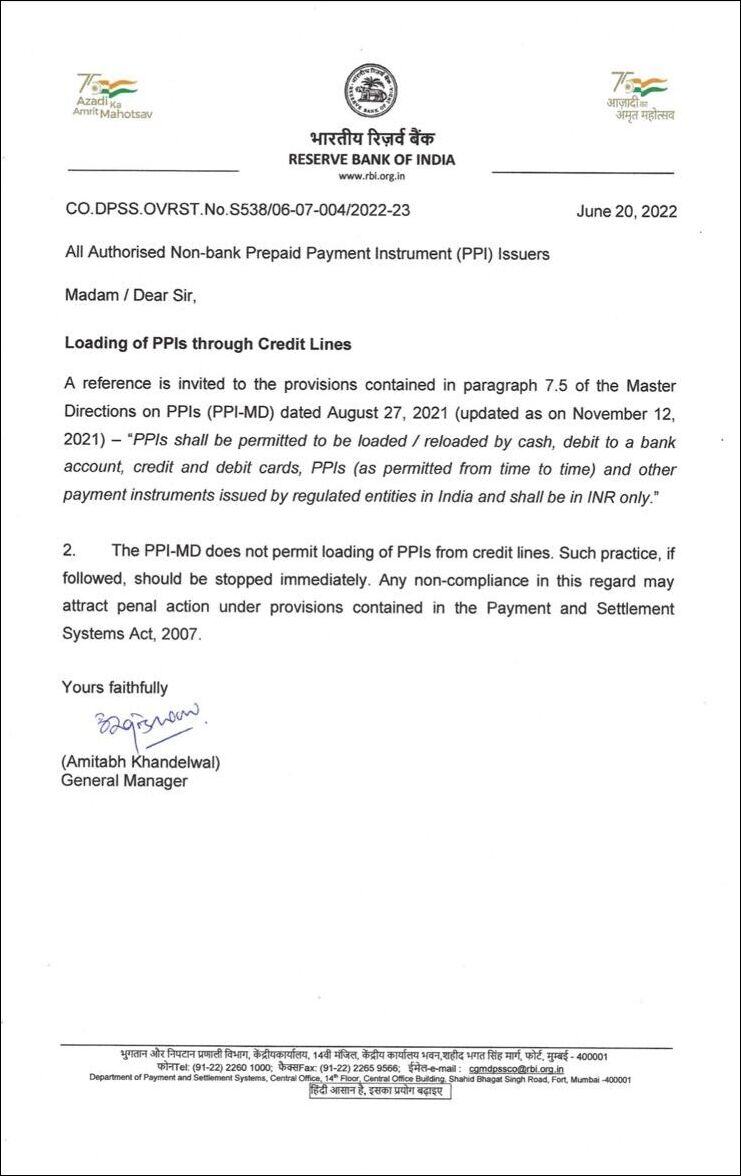

On the 10th of June 2022, RBI issued a circular saying that credit lines cannot be loaded into prepaid instruments. Businesses which processed transactions worth more than 3500 crores were now in jeopardy.

Here are a few articles covering these developments.

This article explores the innovative business models implemented by fintechs and how non-compliance can hurt long-term success. This article also suggests best practices that employers can follow to safeguard the financial security of their employees, especially while evaluating partners and vendors who offer employee financial wellness.

We’ll start by understanding what credit lines and prepaid instruments are.

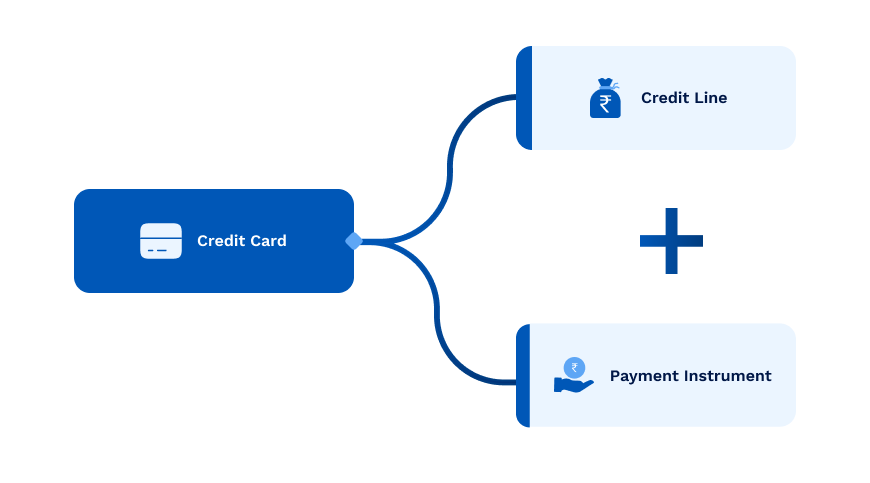

Credit lines are a pre-approved loan amount, usually from a bank or NBFC which may be used as and when required by the customer. For instance, a credit card combines a credit line (provided by your bank) with a payment instrument (plastic card provided by Rupay, VISA or Mastercard).

However, not all credit lines are for credit cards. You also have overdrafts provided by the bank or access to earned wages (EWA) as provided by Refyne in partnership with employers.

What are Prepaid Instruments (PPIs)?

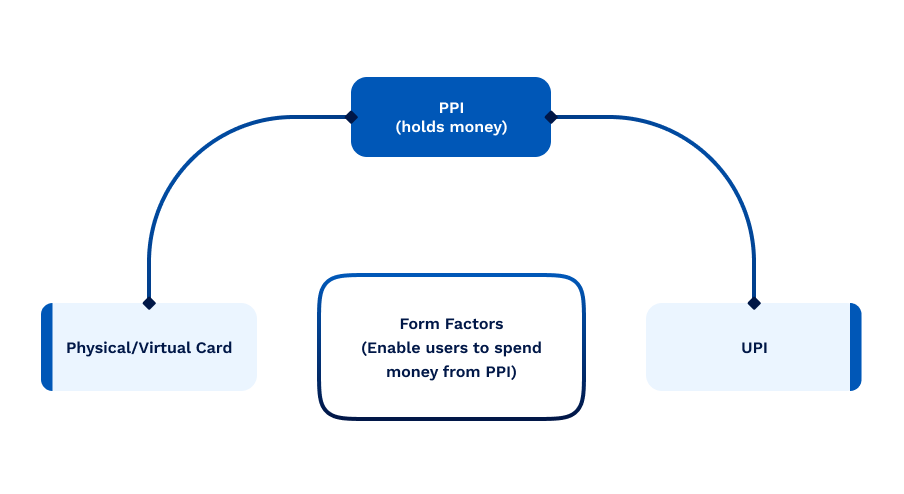

Prepaid instruments are meant to hold stored value just like savings bank accounts. They can be issued by a bank or a PPI-licensed entity and are meant for use cases like gifting or expense management. The prepaid instrument is associated with certain form factors. Form factors are simply means to access and spend the amount stored in the prepaid instrument. Two commonly known form factors are

- Card (physical or virtual)

- UPI

The major differentiating factor between prepaid instruments and bank accounts is that the KYC requirements for opening PPIs are relatively relaxed and not subject to the same level of scrutiny.

The major differentiating factor between prepaid instruments and bank accounts is that the KYC requirements for opening PPIs are relatively relaxed and not subject to the same level of scrutiny.

Savings accounts also have all the features of PPIs (and some more), but there are some key differences between PPIs and savings accounts.

- It’s easier to open PPIs, there are fewer KYC requirements

- PPIs have an upper limit for both the balance that they can hold and the transaction amount in a month

- Savings accounts can only be opened at banks, but PPIs can be opened with non-banks also (licensed PPI entities)

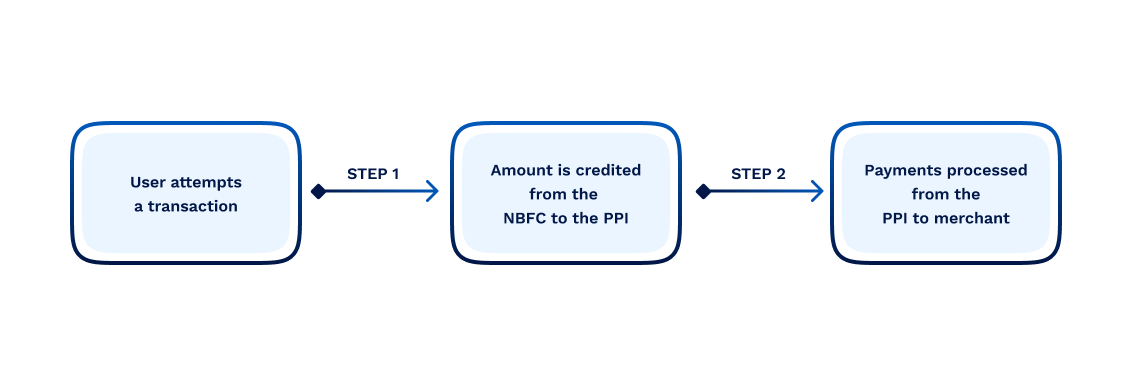

A couple of years ago, some innovative fintech founders found a unique use case for prepaid instruments. They combined credit lines offered by NBFCs with prepaid instruments to create a hybrid credit card. The model took off, and soon there were about one crore prepaid cards in the market, which processed transactions worth more than Rs 3,500 crore in a month.

On the 10th of June, RBI sent out this notification.

The RBI regulation broke the above chain by saying credit lines cannot be loaded into prepaid instruments. Step 1, shown above, was classified as non-compliant, and all PPIs have to be loaded only via banking instruments like account transfers or debit cards.

The central bank clearly said that while it encourages innovation, it should not be based on regulatory arbitrage. Fintechs were replicating credit cards without going through the necessary KYC requirements and underwriting norms required for a credit card.

The latest digital lending guidelines also reemphasise that a credit line must be transferred from the bank account of the lender to the registered bank account of the borrower.

The regulation suddenly put the existing model at risk; multiple fintechs, NBFC, Banks (yes, banks also), and PPI-licensed entities were affected. Licensed entities gave a strict directive to fintechs to stop loading credit lines into prepaid instruments.

Businesses which processed transactions worth more than 3500 crores were now looking at closing down services.

How can you identify fraudulent models?

It is hard for the regulators to monitor all fintechs and NBFCs, and certain non-compliant models may continue to function until they become big enough to be actively audited. However, working with such fintechs and NBFCs is risky and should be avoided. Here are a few basic questions that you should ask.

- Where is the money coming from?

- What is the underlying instrument? A bank account? A credit card? A prepaid instrument?

- How is the money flowing between the multiple entities involved?

- Are direct payments are being made to end merchants without passing through the bank account of the borrower?

It is essential, as an employer, that one remains informed and aware of such models. Availing services from non-compliant organisations can put your employees’ credit scores and financial security at risk. Moreover, if organisations are willing to flout regulations in one aspect, they may do the same in other aspects like data security and collection/recovery processes. While we all appreciate innovation, one can’t ignore the responsibility to ensure that your employees do not become casualties of failed experiments by overzealous organisations.

*Data shared by Payments Council of India (PCI)